summit county utah sales tax rate

The assessors office also keeps track of ownership changes. 7705 This website is provided for general guidance only.

News Flash Summit County Ut Civicengage

The US average is 46.

. - The Sales Tax Rate for Summit County is 78. As far as all cities towns and locations go the place with the highest sales tax rate is Park City and the place with the lowest sales tax rate is Coalville. Method to calculate Summit County sales tax in 2021.

Summit UT Sales Tax Rate. 91 rows This page lists the various sales use tax rates effective throughout Utah. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06.

Income and Salaries for Summit County. To review the rules in Utah visit our state-by-state guide. The state sales tax rate in Utah is 4850.

Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134 taxmasterutahgov 801-297-7705 1-800-662-4335 ext. For questions on how to report your nicotine sales taxes please contact HdL Companies directly here. The table combines the base Utah sales tax rate of 625 and the local county rates to give you a total tax rate for each county.

Summit County is the most expensive place in Utah for car sales taxbuying a car here comes with a sales tax rate of 905. With this article you will learn helpful facts about Summit County real estate taxes and get a better understanding of what to consider when it is time to pay. The 2018 United States Supreme Court decision in South Dakota v.

8 rows The Summit County Sales Tax is 155. The current total local sales tax rate in Summit UT is 6100. It does not contain all tax and motor vehicle laws or rules.

Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87. The US average is 73. The most populous location in Summit County Ohio is Akron.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. With local taxes the total sales tax rate. As far as all cities towns and locations go the place with the highest sales tax rate is Mogadore and the place with the lowest sales tax rate is Uniontown.

- Tax Rates can have a big impact when Comparing Cost of Living. Tax rates are provided by Avalara and updated monthly. A county-wide sales tax rate of 155 is.

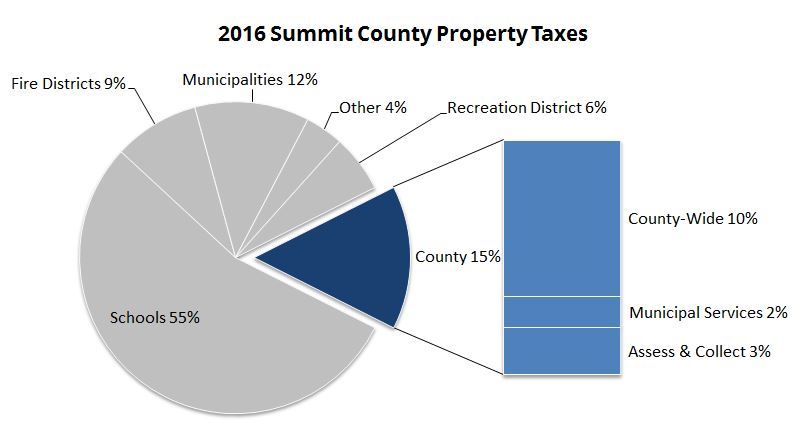

The tax rate is determined by all the taxing agencies-city or county school districts and others-and depends on what is needed to provide all the services you enjoy. Look up 2022 sales tax rates for Summit Utah and surrounding areas. Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax.

Local tax rates can include a local option up to 1 authorized by law mass transit rural hospital arts and zoo highway county option up to25 percent county option transportation town option usually underutilized by most townships at. What you will find in the US which is different from some other countries is that when you see the price of a product such as a t-shirt in a retail store or food. Has impacted many state nexus laws and sales tax collection requirements.

The 2022 Summit County Tax Sale will be held online. The most populous zip code in Summit County Utah is 84098. Piute and Wayne County charge the lowest sales tax for car purchasesthe same as the state tax rate at 685.

Automating sales tax compliance can help your business keep compliant with. The most populous zip code in Summit County Ohio is 44203. The most populous location in Summit County Utah is Park City.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Should you already be a resident. Any sale funds in excess of the total amount of delinquent taxes penalties interest and administrative fees will be treated as Unclaimed Property under Title 67 of the Utah Code Annotated and forwarded to the Utah State Treasurer after one year.

Utah has several different counties 29 in total. The average cumulative sales tax rate between all of them is 675. The Summit County sales tax rate is 155.

The Utah state sales tax rate is currently 485. The average sales tax rate in Colorado is 6078. The amount of taxes you pay is determined by a tax rate applied to your propertys assessed value.

The base state sales tax rate in Utah is 485. The average cumulative sales tax rate between all of them is 778. The state sales tax in Utah UT is 47 percent.

Tax Rates for Summit County. - The Income Tax Rate for Summit County is 50. Sales tax rates for Summit County pdf County sales tax history pdf Mass transit sales tax history pdf To get more information on town sales tax please contact.

You may register as a bidder for the tax. The total tax rate might be as high as 87 depending on local jurisdictions.

News Flash Summit County Ut Civicengage

News Flash Summit County Ut Civicengage

2022 Best Places To Live In Summit County Ut Niche

News Flash Summit County Co Civicengage

Wasatch Summit County Property Taxes How They Work Park City Real Estate Agent Nancy Tallman

Summit County Short Term Rental Restrictions

News Flash Summit County Ut Civicengage

Summit County Sales Tax Revenues Show Continued Economic Comeback In Wake Of Covid Parkrecord Com

Summit County Council Considers Regulating Nightly Rentals Amid Influx Of Units Parkrecord Com

Summit County Utah Republican Party

News Flash Summit County Ut Civicengage

News Flash Summit County Ut Civicengage

Sales Tax Increase For Summit County Begins October 1

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Property Taxes When To Consider An Appeal Choose Park City Luxury Real Estate Agents

Two Bulls In Summit County Cattle Herds Test Positive For Disease State Veterinarian Says